-

Nieuws Feed

- EXPLORE

-

Blogs

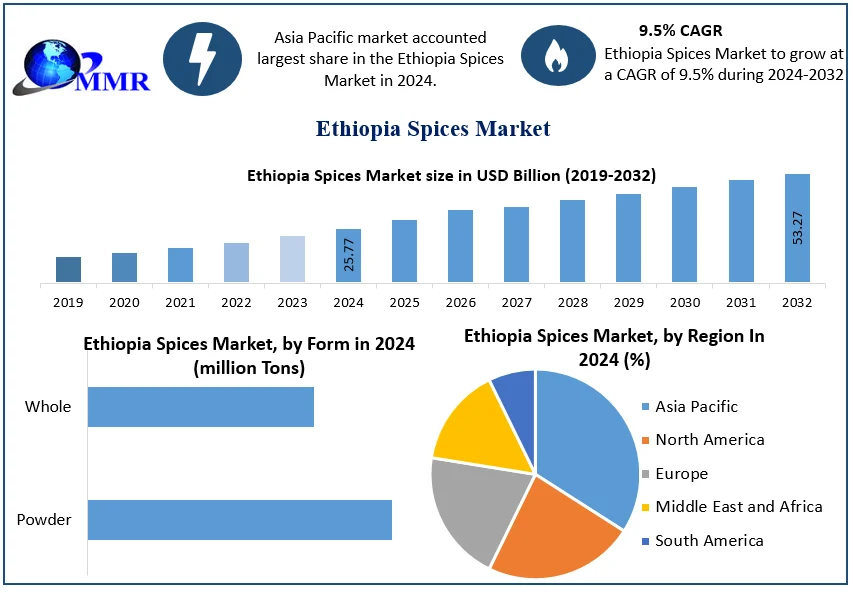

Ethiopia Spice Industry Set to Surge: Projected to Hit US$ 53.27 Million by 2032

The Ethiopia Spices Industry size was valued at 25.77 million Tons in 2024 and the total Ethiopia Spices Market revenue is expected to grow at a CAGR of 9.5 % from 2025 to 2032, reaching nearly 53.27 million Tons by 2032.

Market Overview

Pimento pepper (290K tons), spices except pepper and ginger (232K tons), and (10K tons), were the main products of spice consumption in Ethiopia Spices Market, together accounting for 80-90 % of the total volume. Piper pepper, cinnamon Anise, fennel and coriander, clove, nutmeg, mace, cardamoms, and vanilla are together accounting for 10-15 %. The value of exports of commodity group 0910 "Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry, and other spices" from Ethiopia total $ 3.22 million in 2022.

Ask for Sample to Know US Tariff Impacts on Ethiopia Spices Industry @ https://www.maximizemarketresearch.com/request-sample/232586/

Market Trends:

Consumers worldwide have shown a growing preference for organic and sustainably sourced products, including spices. This trend is likely to influence the Ethiopia Spices Market, with an emphasis on environmentally friendly and socially responsible practices. There is an increasing demand for ethnic and exotic flavors in the food industry. Ethiopia, with its rich culinary traditions and unique spices, may benefit from the growing interest in diverse and authentic flavors. Health-conscious consumers are seeking spices not only for their flavor but also for their potential health benefits. Spices are often recognized for their antioxidant and anti-inflammatory properties, contributing to the overall health and wellness trend.

Innovative and sustainable packaging solutions have gained importance. Ethiopia Spices Market trend aims to reduce environmental impact and enhance the overall appeal of spice products. Modernizing processing facilities and adopting advanced technologies for spice production and processing enhance efficiency and quality, potentially boosting the competitiveness of Ethiopian spice products. Considering the one spice, the production trend of ginger in Ethiopia is fluctuating and declining due to various factors such as pests and diseases, lack of improved varieties, poor agronomic practices, and market constraints.

Market Dynamics:

Opportunities for spices production and marketing in Ethiopia:

The agriculture sector is the pillar of the Ethiopia Spices Market and Ethiopian economy as it contributes 34.1% to the gross domestic product (GDP) offers about 79% of foreign exchange earnings and creates job opportunities for about 79% of the population. Next to coffee, the Ethiopian pulses, oilseeds, and spices sectors are among the critical components of the agricultural sector contributing to high foreign exchange revenue as reported by the Ethiopian Ministry of Industry (EMI (Ethiopian Ministry of Industry).

The major opportunities for spices, herbs, and aromatic crops in Ethiopia include the appropriate or suitable environment for the introduction and cultivation of different spice crop varieties, increasing local markets and demand by international hotels, medicinal factories, spa and massage services (EMI (Ethiopian Ministry of Industry), 2015). Ethiopia Spices Market has a suitable and conducive environment for spice crop production due to the presence of varied climatic conditions and agro-ecologies, vast cultivable and irrigable land, and an encouraging government policy environment.

Segmentation Analysis

The market is segmented based on:

by Product

Mitmita

Berbere

Niter Kibbeh

Awaze

Turmeric

Cardamom

Fenugreek

Bayleaf

Others

by Form

Powder

Whole

by Region:

North America (United States, Canada, and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of MEA)

South America (Brazil, Argentina Rest of South America)

Explore the full report for an in-depth analysis: https://www.maximizemarketresearch.com/market-report/ethiopia-spices-market/232586/

Regional Insights:

The spices produced under smallholder in Ethiopia Spices Market are korarima (Aframonum Korarima), long red pepper, ginger, turmeric, cardamom, black pepper, black cumin, white cumin/ Bishops weed (Nech azmud), coriander, fenugreek, c, sage, and cinnamon. However, korarima, pepper, black cumin and cardamom are the four most important spices produced in Ethiopia. The SNNP, Oromiya and Amhara regions contributed respectively 37%, 32%, and 25% to the average annual spice production during the period 2020-2022.

In three major spice-producing regions of Ethiopia Spices Market, the area coverage, production, and productivity of some of the spices are 6,742.99ha, 37,736.4MT, 5.6ton/ha of ginger, 1002.2ha, 3962.03MT, 3.95ton/ha of turmeric and 9233.30ha, 5,625.25MT, 0.61ton/ha of cardamom, respectively. Sudan is the leading importer of spices from Ethiopia with a 38.4% share of the value of total spices exported from Ethiopia, followed by India 10.4%, and Yemen 8.6%.

Competitive Landscape

1. Adikap Exports., Addis Ababa Ethiopia.

2. Daniel Desalegn., Addis Ababa Ethiopia.

3. Sametha Trading., Addis Ababa Ethiopia.

4. Zowe Trading PLC. Addis Ababa, Ethiopia.

5. YEKUNENI PLC. Addis Ababa Ethiopia.

6. Abki Spice, Addis Ababa Ethiopia.

7. Trade key, Ethiopia

8. Feed Green Ethiopia, Ethiopia

9. Tradeford, Ethiopia

Conclusion

With its rich agricultural heritage and expanding global appeal, the Ethiopian spices market is set for significant growth. By embracing sustainable farming, value addition, and improved market access strategies, Ethiopia has the opportunity to strengthen its position as a prominent player in the international spices industry.

Frequently Asked Questions:

1. What are the factors affecting the Ethiopia Spices Market?

2. What are the major spices in the Ethiopia Spices Market growth?

3. What is the projected market size and growth rate of the Ethiopia Spices Market?

4. What segments are covered in the Ethiopia Spices Market report?

5. Which region has the largest share in Global Ethiopia Spices Market?